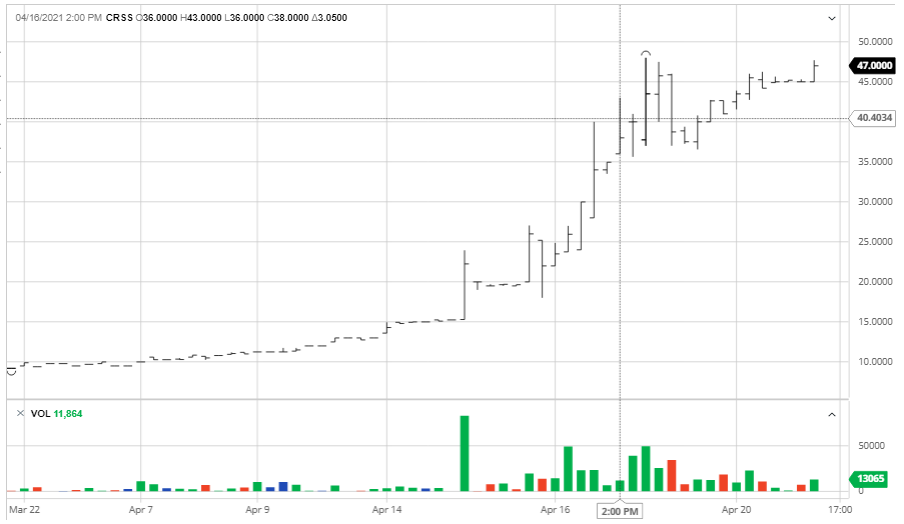

Crossroads Systems, Inc. (OTCQX: CRSS) is a holding company focused on investing in businesses that promote economic vitality and community development. Crossroads’ subsidiary, Capital Plus Financial (CPF), is a certified Community Development Financial Institution (CDFI) and certified B- Corp, which supports Hispanic homeownership with a long term, fixed-rate single-family mortgage product. Some may recall seeing Crossroad’s presentation at Rocky Mountain Microcap Conference IV which was held at Coors Field in Denver, Colorado May 5, 2019. At that time the stock was trading around $7.75 per share.

Crossroads has made a considerable move over the past week or two, which has had many of us wondering what the genesis of the move might be.

After digging a bit, here is what we have been able to discover. (We will try to make this as brief as we can).

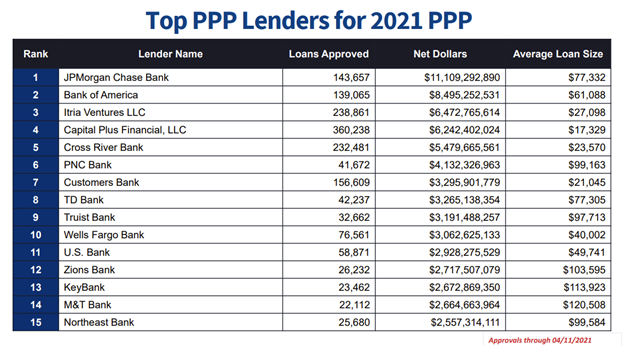

As some may be aware, calendar 2021 brought a second round of federal PPP loans but in this iteration the government has attempted to steer these loans to small businesses, self-employed workers, sole proprietors, gig workers and other small enterprises. To put it into perspective, according to the SBA, through 04/11/21 this second PPP program has made just over 4.4 million loans for a total of approximately $233 billion, and nearly 82% of those loans have been for $50,000 or less and many of those have been for considerably less .

(https://www.sba.gov/sites/default/files/2021-04/PPP_Report_Public_210411-508.pdf) .

Crossroad’s subsidiary, Capital Plus Financial has a relationship with a Lender Service Provider called Blueacorn (www.blueacorn.co). As we understand it Blueacorn essentially helps PPP applicants prepare their PPP paperwork and then submits it to a bank (captial Plus) to secure their loan with the SBA. Apparently, Capital Plus Financial and Blueacorn have been busy. According to the SBA’s PPP website, as of 04/11/21 Capital Plus has ranked 1st for the most PPP loans approved (360,238) and 4th for the largest aggregate dollar amount of those loans ($6.2 billion). We would add, their loan average was the lowest of all these lenders at $17,329 per loan. Frankly, we are shocked by those numbers, especially in the context of the other names on this list.

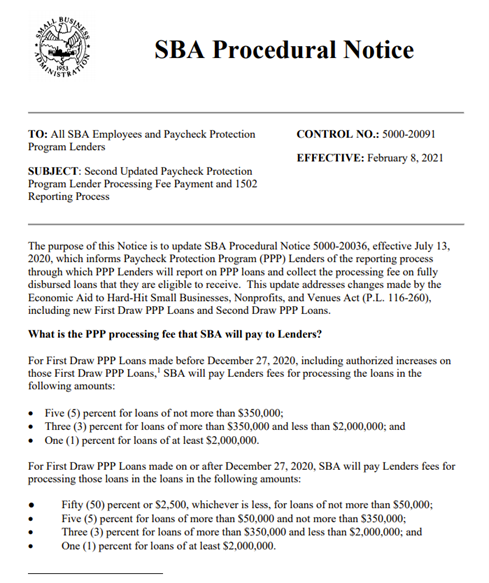

Having gathered this information, our next question was, “what does Capital Plus Financial get for generating 360,000 PPP loans worth $6.2 billion”? The next chart may shed some light on that as well:

The above graphic is also from the SBA’s PPP site. If we understand this correctly, for loans under $50,000 (recall Capital Plus’s average loan was roughly $17,000) the lenders are paid a processing fee of “50% or $2,500 per loan, whichever is less”. So here is that math: 360,238 loans at $2,500 each, implies fees of $900,595,000. Moreover, this program was recently extended to May 31, 2021, so presumably, they will likely write more of these loans. We are beginning to understand the recent rise in the stock.

The above said, here are the loose ends.

While the above information is obviously public, Crossroads has made no public comment on this information or on their PPP activities in general. While we submit, the numbers look straightforward to us, there may be more to this that either are not apparent on the face, or that we are not correctly understanding. It is entirely possible that we are missing something here, but judging from the rise in the stock, if we are missing something, we are not the only ones missing something.

Second, we noted that Capital Plus has a relationship with Blueacorn, which we assume is probably responsible for facilitating most of Capital Plus’s 360,000 loans. We assume this because if we go to the PPP portion of Capital Plus’s website, we find that they direct applicants to Blueacorn for assistance in preparing the loan:

So then, what we do not know, is the arrangement between Capital Plus and Blueacorn. As we noted above, if our assumptions are correct, it looks to me like Capital Plus has generated a large balance of fees related to these loans, but the question is, does Capital Plus share most of this, just a small portion of this or something in between with Blueacorn? If we knew the answer to that it would be a lot easier to ascertain if the recent highs in the stock are appropriate (or still a good value). Given that despite the stark rise in the price of their shares, Crossroads has not provided any color on their PPP business to this point, we suspect we may need to wait for their Q1 numbers to get more specific color. Whatever the minutia, it looks quite likely to us that Crossroad’s 1H-F21 looks like a blowout.